What Is Home? Hire an Agent For Your Perfect Home.

Home is more than just a place to live. It’s where we create memories, build relationships, and feel safe and secure. Home is a sentimental thing, where so much of your life happens, and finding the perfect home can be a challenging and overwhelming process. Hire an agent for the perfect home

What Is Home?

Home is more than just a physical space. It’s a place where we can be ourselves and feel comfortable in our own skin. It’s where we create our fondest memories, whether it’s cooking dinner with our loved ones, watching a movie with our family, or celebrating special occasions. Home is a place where we can relax, recharge, and feel safe and secure. It’s a space where we can be surrounded by the things we love, whether it’s family photos, artwork, or our favorite books. Home is where we can express ourselves and create an environment that reflects our personality and style.

Why Hire an Agent for Your Perfect Home

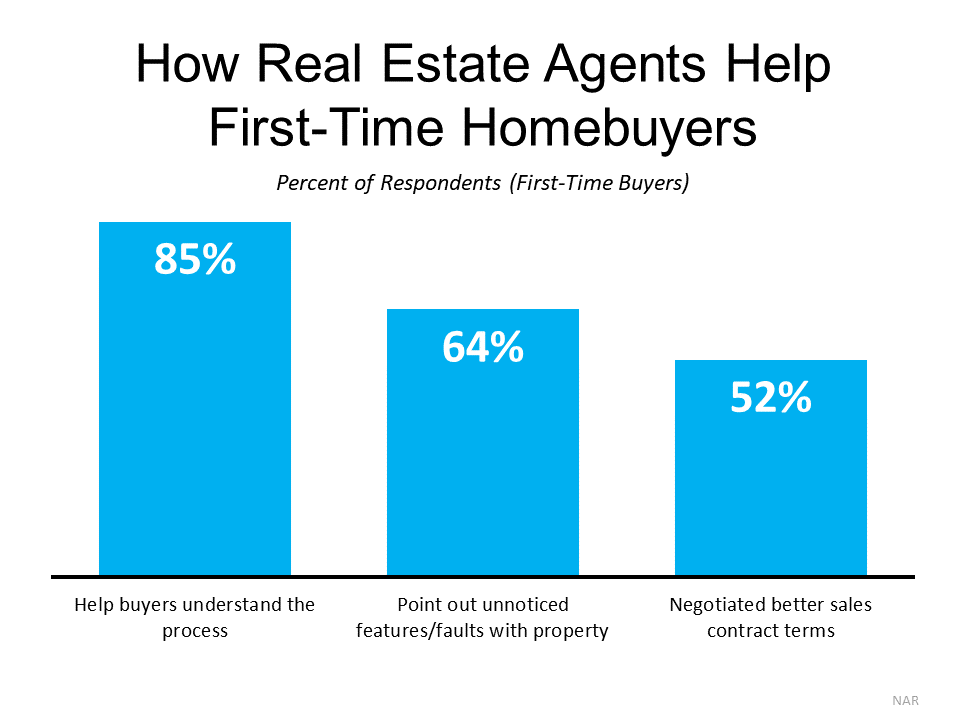

Buying a home is a significant investment, both financially and emotionally. That’s why it’s essential to have a professional by your side who can guide you through the process and help you make informed decisions, especially in todays market. Here are some reasons why hiring an agent matters:

-

Expertise and Knowledge

Real estate agents are experts in their field. They have extensive knowledge of the local market, including trends, pricing, and inventory. They can also provide you with valuable insights into different neighborhoods, schools, and amenities, which can help you make informed decisions about where to buy your home.

-

Negotiation Skills

Negotiation is a critical aspect of the home buying process. Real estate agents have excellent negotiation skills and can help you get the best deal possible. They can negotiate on your behalf and handle any conflicts that may arise during the process, such as issues with the inspection or appraisal.

-

Time-Saving

Buying a home is a time-consuming process, from searching for properties to completing paperwork. Real estate agents can save you time by handling many of the tasks involved in the process. They can help you narrow down your search, schedule property viewings, and guide you through the paperwork, freeing up your time to focus on other important tasks.

Home Buying

Buying a home is an exciting but daunting process. Here are some steps to help you find your perfect home:

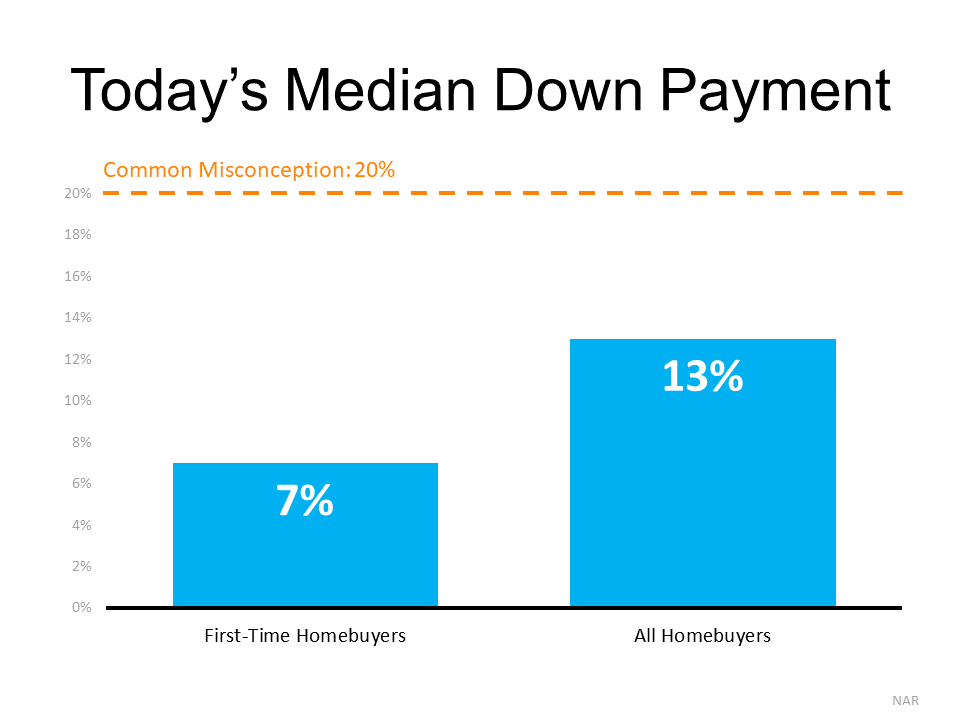

- Determine Your Budget

Before you start looking for a home, it’s essential to determine your budget. This will help you narrow down your search and ensure that you’re looking at properties that are within your price range. Your real estate agent can help you with this process by providing you with a pre-approval letter from a lender.

- Determine Your Must-Haves

Make a list of the features you must have in your home, such as the number of bedrooms, bathrooms, and square footage. This will help you narrow down your search and ensure that you’re looking at properties that meet your needs.

- Work With a Real Estate Agent

Working with a real estate agent is crucial when buying a home. They can help you find properties that meet your criteria, negotiate on your behalf, and guide you through the process.

Conclusion

Home is more than just a physical space. It’s where we create memories, build relationships, and feel safe and secure. Buying a home is a significant investment, both financially and emotionally. That’s why hiring an agent matters when looking for your perfect home. They have the expertise, negotiation skills, and time-saving abilities to guide you through the process.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link